Donna Frosco, Partner

May 20, 2020

Multinational and foreign business and non-profit entities conducting business in the United States may find the layers of regulations inherent in the United States’ federal/state/local regulatory scheme rather complex in “normal” times. For that reason, Dunnington created a “Doing Business in the United States” brochure which you can find here.

However, during the COVID-19 pandemic, things have become even more complicated. To help foreign entities with U.S. operations identify issues states-side business units may face in these unprecedented times, we offer the following questions for consideration and provide information, examples and resources which may be helpful in assessing your particular circumstances.

- Is My Business Eligible For Financial Relief?

Not surprisingly, your first concern may be one of cash flow. In the U.S., in response to the significant economic disruption caused by the pandemic, the federal government enacted the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”). (Dunnington’s summary of various loans and loan forgiveness programs pursuant to the CARES Act thus far can be found here.) Significantly, U.S. subsidiaries of foreign entities were not excluded from eligibility for relief under the CARES Act.

The U.S. federal government is expected to enact additional economic stimulus legislation. On May 15, 2020, the U.S. House of Representatives passed a proposed bill (the “HEROES Act”), which, inter alia, would make available additional funds for emergency grants to small businesses through the Economic Injury Disaster Loan Program and would extend federal unemployment insurance through January 2021. The bill will require Senate approval and signature by the President, both of which may face opposition. Progress on the bill, however, should be monitored closely to determine eligibility for relief under any final, enacted law and to be prepared to submit an application if you are eligible.

At the state and local levels, legislation and executive orders have been enacted to provide regional relief such as postponement of tax filing dates, reduction or waiver of late fees for municipal filings, and implementation of other measures intended to relieve cash crunch and logistical issues during government-mandated shut downs. For example, in New York, consumers may be eligible to defer payment of insurance premiums and a moratorium has been placed on cancellation of some insurance policies. (See press release from New York State Department of Financial Services here.) New York also has implemented a moratorium on tenant evictions and foreclosure of mortgages to June 20, 2020. (See Executive Order No 202.8 here.) On May 7, 2020, Executive Order 202.28 extended the moratorium on tenant evictions and foreclosures to August 20, 2020 if the non-payment of rent or mortgage is by “someone that is eligible for unemployment insurance or benefits under state or federal law or otherwise facing financial hardship due to the COVID-19 pandemic.” (See Executive Order No 202.28 here.)

Each program/regulation/law will differ in scope, eligibility and application requirements. You should monitor developments in each jurisdiction in which your U.S. operations are located and/or doing business. As of the time of this writing, enacted and pending legislation related to COVID-19 in all 50 states is available from the National Conference of State Legislatures here.

- Will New Immigration Directives Impact My U.S. Operations?

Many U.S. subsidiaries and affiliates of foreign entities are accustomed to, and may rely on, movement of non-U.S. citizen personnel to and from the United States. Suspension of immigration processing services, changes to visa eligibility and travel suspensions may impact your ability to retain or assign foreign nationals to roles in your U.S. operations.

As highlighted in widespread news coverage, in late April, U.S. President Trump issued a proclamation “pausing” immigration to the United States. However, there are several significant exemptions. For a summary of the proclamation and exemptions, see Dunnington’s Immigration client alert here.

Many processing services remain unavailable. The U.S. Citizenship and Immigration Services has suspended routine in-person services until at least June 4, 2020. (Information can be found here.) The Bureau of Consular Affairs has suspended routine visa services at all U.S. Embassies and Consulates. (More information can be found here.) However, as employees with current visas may be changing roles (or compensation packages) implicating changes in visa status, and anticipating the likely backlog when government offices re-open, you may wish to prepare anticipated filings now to be able to act immediately upon government office re-openings.

A travel ban currently remains in effect for certain countries. Copies of the most recent proclamations halting travel of certain non-U.S. citizens from the United Kingdom and the Schengen Area can be found here and here. More information from the U.S. Department of State can be found here.

- What Employment Issues Loom Large in Light of COVID-19?

As many jurisdictions begin a process of “re-opening” after mandatory quarantine/stay-at-home orders, multiple measures have been enacted relating to U.S. employees. All employers of personnel in the United States should keep abreast of fast-moving developments. Several key topics for consideration include:

When Can We Reopen?

Decisions regarding termination of quarantines/re-opening of businesses are being made state-by-state.

a. New York State has adopted a plan by which regional assessments will be made based on compliance with seven (7) metrics. Once a region achieves compliance in all seven categories, reopening can begin in phases. Phase 1 includes resumption of nonessential construction projects, manufacturing, wholesale trade, retail sales for curbside pick-up, agriculture, forestry and fishing. A state government dashboard of each region’s achievement for each metric is available here. The complete state-issued guide on “New York Forward” can be found here.

b. On May 14, 2020, New York Governor Cuomo issued Executive Order No. 202.31 that allowed Phase 1 reopening in certain regions of New York State as of May 15, 2020. New York City has not yet reached metric compliance for re-opening eligibility. However, the executive order is a preview of the anticipated reopening process in New York City. The complete executive order is here.

c. Executive Order No. 202.31 also extended the New York state disaster emergency declaration to June 13, 2020.

d. Social distancing and non-essential business closures remain in place for New York City.

COVID-19 and Non-discrimination:

a. Employers should be aware that the New York State Division of Human Rights (DHR) has declared that discrimination involving COVID-19 can violate New York State’s Human Rights Law (HRL). The HRL prohibits discrimination against individuals who are assumed to have been exposed to COVID-19 based on a wide variety of personal characteristics, including race, national origin, and disability. More information can be found on the DHR’s website here.

b. Similarly, on the federal level, the U.S. Equal Employment Opportunity Commission (EEOC) has provided guidance that can help employers navigate dealing with COVID-19 in the workplace. The EEOC guidance and additional information can be found here.

Health & Safety Issues:

a. The U.S. Department of Labor’s Occupational Safety and Health Act of 1970 (“OSHA”) requires employers to be responsible for maintaining a safe and healthy work environment for employees. See here. While we have yet to see how this requirement will be implemented in a COVID-19 environment, it is worth noting that OSHA also has established a recordkeeping requirement that mandates employers to log work related injuries and/or illnesses. Under this mandate, if an employee is infected with COVID-19 while at work, an employer may need to record this in their log. More information from OSHA regarding the injury and illness recording mandate can be found on OSHA’s website here.

b. COVID-19 responses have varied by region in the United States. It is imperative that businesses monitor and comply with location-specific regulations. For example, in New York, employers must provide face coverings to all employees in the workplace and employees are required to wear these face coverings when in contact with customers or members of the public. (NY Executive Order 202.16 available here.)

Other Potential COVID-19 Related Claims:

Other issues are likely to arise, including those relating to leave requests from employees who are ill, caring for someone who is ill, or have trepidation relating to a return to the workplace. (In fact, lawsuits from the recently-enacted federal Families First Coronavirus Response Act or “FFCRA,” have already been commenced.) Similarly, claims pursuant to the Americans with Disabilities Act (“ADA”) and/or the Family Medical Leave Act (“FMLA”) are likely. Depending on your industry and status of your employees, wage and hour issues also may arise. Proactive measures taken now – such as adoption of policies, implementation of procedures for consistent administration of policies, appointment of a designated management team member to field COVID-19 related employee questions, training of managers on handling leave requests, etc. – may help avoid disputes later.

- Do I Have Insurance Coverage for a Pandemic?

Every business should review their policies and coverages. Unlike the All England Tennis Club or the Royal & Ancient Golf Club of St. Andrews in the U.K. (both of which reportedly have global pandemic insurance policies which apply to cancellation of this year’s The Championships Wimbledon and the British Open, respectively), most businesses will look to business interruption coverage. This type of coverage usually protects the insured against losses resulting from an inability to conduct normal operations. Whether, and to what extent coverage may be available, will depend on the language of the policy in question and is highly fact specific. Careful attention to policy details, exclusions, notice periods and other provisions will be required in evaluating any claim.

Business interruption insurance in the United States is regulated at the state level. As general guidance, Dunnington has issued Ten Tips for Navigating a Business Interruption Claim in New York: here.

- Are My U.S. Operations Prepared for Sustained Remote Working?

Given the gradual nature of easing of lock-downs and closures, expected restrictions on the extent of physical occupancies upon reopening, and a potential migration to or expansion of on-line business, entities should evaluate their privacy and data protection policies and practices.

Unlike many other jurisdictions, the United States does not have general, non-industry specific, national data privacy regulation. Therefore, you should be aware of and monitor compliance with state laws applicable to your U.S. operations. For example, the California Consumer Privacy Act, which came into force on January 1, 2020, applies to personal data of California Residents gathered by any entity meeting certain threshold criteria irrespective of the entity’s physical location. (Information on the status of regulations pursuant to the CCPA can be found here.) On March 21, 2020, New York’s Stop Hacks and Improve Electronic Data Security Act (“SHIELD Act”) became effective. The SHIELD Act (a) imposes data security requirements of businesses, (b) expands the definitions of “private information” and “breach” and (c) expands the territorial scope of data breach notifications.

Most businesses did not have a pre-pandemic plan for a complete, or even majority, remote workforce. Even as restrictions are lifted, it is likely that limitations will remain on occupancies and the number of employees who may be present at a location at a given time. Therefore, remote working likely will be with us for the foreseeable future. Particular care should be exercised in relation to data handled by employees working remotely. Are your technology licenses up to date? Does your privacy policy require updating to address work-from-home? What is the status of your business’s data security in a remote work environment? Are your technology licenses sufficient, and is the technology you have in place secure?

Bonus Tip: Don’t Forget Your Intellectual Property!

In the United States, intellectual property – including your entity’s brand – is treated as intangible personal property which can be bought, sold, licensed and monetized. Although protection of intellectual property rights may not be the first concern of many businesses in a global crisis, preservation of ownership and valuable rights in intangible assets should be afforded the same care – if not greater – than a business’s physical assets.

It is worth noting that U.S. courts have continued to issue decisions during lock-downs, many of which directly impact protection of intellectual property. The United States Supreme Court even chose a case involving trademark for the first argument to be held remotely by the Court due to social distancing restrictions.

To help you keep up to date with copyright and trademark cases and developments of note, Dunnington posts updates and its periodic Trademark Bulletins here. A Dunnington status report on COVID-19 related notices from the United States Patent & Trademark Office and the United States Copyright Office is available here.

Government responses to COVID-19 remain dynamic as the United States addresses the pandemic. Dunnington will continue to issue alerts to aid our clients and post information and links to resources here. If we can be of assistance to your U.S. operations, please contact us.

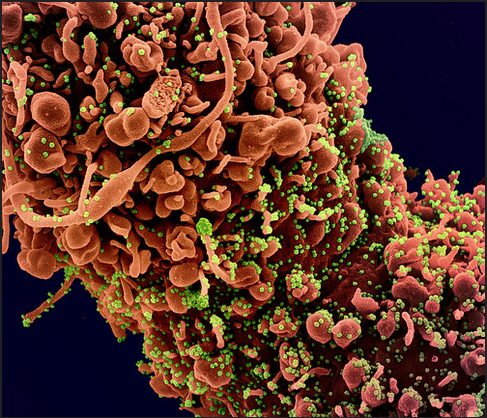

“Novel Coronavirus SARS-CoV-2” Courtesy: NIAID/NIH

*Required Disclaimer: This alert is provided for informational purposes and does not constitute, and should not be considered legal advice. Specific facts and circumstances will differ. Links to third-party content are provided for information only; Dunnington does not necessarily endorse, cannot guarantee the availability or accuracy of, and is not responsible for, any third-party content that may be accessed via such links. Neither the transmission nor the receipt of this information shall create an attorney-client relationship between the transmitter and the recipient. You should not take, or refrain from taking, any action based upon information contained in this alert without consulting legal counsel of your own choosing. Under applicable professional rules of conduct, this informational publication may be considered attorney advertising. Dunnington does not endorse nor take any position whatsoever concerning any third party entities mentioned in this alert.